SMS Marketing for Mortgage Brokers: The Game-Changer You have Been Missing

Your client just got approved for their dream home loan. You send them an email with the good news. They see it three hours later. Meanwhile, your competitor sends a simple text: “APPROVED! Rate...

Your client just got approved for their dream home loan. You send them an email with the good news. They see it three hours later.

Meanwhile, your competitor sends a simple text: “APPROVED! Rate locked at 6.1%. Call us now!”

Guess who’s getting the referrals?

Look, you’re already juggling rate sheets, underwriters, and anxious clients. The last thing you need is another marketing channel to manage.

Pizza places figured this out years ago. Real estate agents are catching on. And the mortgage brokers who embrace SMS marketing? They’re leaving everyone else behind.

Time to level up.

Why SMS Marketing Works for Mortgage Brokers

Think about the mortgage process from your client’s perspective. They’re confused and drowning in paperwork. The last thing they want is another 500-word email explaining interest rate fluctuations.

But a quick text saying “Great news! Your rate just locked at 6.2%” can save the day.

SMS works because it matches how people actually communicate today. Short and immediate. You’re just giving them the information they need when they need it.

Plus, there’s something personal about texting. When you text someone, you’re on their phone screen in seconds. That’s prime real estate for building relationships and staying top-of-mind.

Easify makes this whole process seamless. Instead of manually sending texts from your personal phone (please tell us you’re not doing that), you can automate everything while still keeping it personal.

Key Use Cases of SMS in Mortgage Marketing

So we’ve gone over the perks – texting is quick. It feels personal. And it gets read almost instantly. For mortgage professionals, that makes it a powerful way to connect at every stage. You can use SMS to follow up with a lead, send reminders, or keep clients updated on their loan. Here’s exactly how to use SMS in your mortgage business:

Lead Nurturing

Remember that lead who downloaded your rate calculator three months ago? They’re probably house shopping right now.

Send them a quick text to remind that you exist:

Easify lets you set up automated drip campaigns that feel personal. Your leads get consistent touchpoints without you putting in that extra effort.

Appointment Reminders

No-shows are profit killers. A simple reminder text cuts no-shows by up to 40%.

It just takes one text. Problem solved.

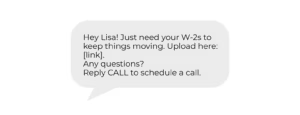

Document Submission Reminders

We both know clients forget to submit documents. It’s not intentional. Most often, they’re just overwhelmed.

Instead of calling and leaving awkward voicemails, shoot them a text:

Easify can automatically send these reminders when documents are overdue. Easy-peasy!

Rate Alerts & Updates

Rate changes are perfect SMS material. Quick, urgent, actionable.

Rate changes aren’t just random information. It’s a reason to reconnect and potentially close business.

Customer Retention

Past clients are your goldmine. They already trust you and have friends who need mortgages.

Text them on their home anniversary:

Best Practices for SMS Marketing in Mortgage Industry

You’ve seen why SMS matters and where it fits in. Next up: how to make your texts sound natural and professional, not robotic. Here are some best practices for SMS marketing in the mortgage industry:

Short, Clear, Professional Messages

Keep texts under 160 characters when possible. Get to the point fast.

Bad: “I hope this message finds you well. I wanted to reach out regarding the status of your mortgage application and provide you with an update on the current market conditions…”

Good: “Your loan cleared underwriting! Closing scheduled for next Tuesday. Call me with questions.”

Personalization

Use their name. Reference their specific situation. Easify pulls client data from your CRM to help messages feel personal.

“Hi Jennifer! Your Oakwood Drive appraisal came in at $425k – right on target for your loan amount.”

Clear CTAs

Tell people exactly what you want them to do.

“Reply YES to lock this rate” is better than “Let me know your thoughts.”

Proper Timing

Nobody wants mortgage updates at 6am or 10pm. Stick to business hours.

Easify lets you schedule messages, so that you don’t end up texting your clients at “do not disturb” hours.

Compliance Considerations

Time to talk about the legal stuff. No matter what you do, do not skip this section. Getting SMS compliance wrong is expensive.

TCPA and GDPR Rules

The Telephone Consumer Protection Act has strict rules that you must adhere to. For instance, here’s a mandatory one: you need explicit consent before texting your clients.

GDPR applies if you have any European clients. Same rules – clear consent required.

Opt-ins

Get permission first. Every time. Add SMS opt-ins to your website forms:

“□ Yes, text me rate updates and mortgage tips”

Opt-outs

Make it easy for people to stop receiving texts. Include “Reply STOP to opt out” in every marketing message that you send.

When someone opts out, respect it immediately. No “are you sure?” or “one last message.”

Record-keeping

Document everything. When they opted in, what they consented to, and when they opted out. Keeps detailed records and ensures compliance.

Integrating SMS with Mortgage Marketing Strategy

SMS is a great stand-alone tool for sure. But guess what? It also works really well when paired with your other marketing channels:

Email + SMS

Use them together, not in competition. For instance, you can send a detailed rate analysis via email. Later, follow up with a text:

“Sent you rate details via email. Bottom line: you could save $200/month. Free to chat?”

CRM Integration

Your SMS platform should talk to your CRM. When someone texts back expressing interest, that should trigger a follow-up task.

This way, you can make sure that nothing falls through the cracks.

SMS Surveys

Quick feedback collection: “Rate your closing experience 1-5 (1=poor, 5=amazing)”

Responses give you testimonials and help identify referral opportunities.

How Easify Helps Mortgage Brokers

Here’s where Easify becomes your secret weapon:

Bulk and Automated Texting

Send personalized messages to hundreds of clients instantly. Rate alerts, market updates, seasonal check-ins – all automated but personal.

Two-way Texting

Clients can text back, and you can respond instantly from your phone or computer. No more switching between devices or missing messages. Easify’s chat-style SMS feature sure does make things convenient.

CRM Integration

CRM integration is super important. You can’t always go back and forth to store or retrieve customer data. Client data should flow seamlessly, and every interaction should get logged automatically.

Analytics

See open rates, response rates, and conversion metrics. Know what messages work and what don’t. Easify’s SMS analytics helps you track the performance of your SMS campaigns. This way, you can see what’s working and what’s not.

Real-Life Scenarios / Examples

Let us paint some pictures for you, so that you get a better idea on how to use SMS:

Scenario 1: The Stressed First-Timer

Sarah’s buying her first home. She’s panicking about every email and calling you twice a day.

Solution: Set up automated SMS updates through Easify. “Day 5: Ordered appraisal ✓ Next: Wait for report (3-5 days).” Sarah stops the frequent calls because she knows exactly what’s happening.

Scenario 2: The Rate Shopper

Mike’s been shopping rates for months. He’s on everyone’s email list but hasn’t committed.

Solution: Text him when rates drop: “Mike – rates at 6.1% today, lowest in 2 months. 15-min call to discuss?” He responds within an hour and locks his rate.

Scenario 3: The Referral Goldmine

Jennifer closed 6 months ago. She’s happy but you’ve lost touch.

Solution: Easify sends an automated text on her home anniversary: “Hey Jennifer! Happy 6-month home anniversary! How’s homeownership treating you?” She replies that her coworker is buying and needs a broker recommendation.

Scenario 4: The Document Dodger

Tom keeps “forgetting” to submit his tax returns. It’s holding up his closing.

Solution: Automated reminders via Easify: “Tom – still need 2023 tax returns. Closing in 10 days. Upload here: link or call me.” He submits them that afternoon.

Conclusion

Being in the mortgage industry, you know that everything happens quick. Your clients want quick, clear communication. Your competitors are probably already texting them. And honestly, managing all this manually is a waste of your valuable time.

Easify makes SMS marketing simple, compliant, and effective. You can automate the routine stuff while keeping it personal. You can integrate with your existing systems without starting over. And you can start seeing results immediately.

Stop playing catch-up. Start leading.

Ready to transform your mortgage business with SMS marketing? Try Easify free for 7 days and send your first campaign this week. Because in the mortgage business, the fastest communicator wins. And with Easify, that communicator is you.

Navigating the Complex World of Digital Communication with Easify In the ever-evolving landscape of digital marketing, the thin line between effective communication and spam is crucial. Easify’s AI Compose tool emerges as a key player, ensuring that your SMS and email campaigns reach their intended audience without being flagged as spam. This tool stands out by understanding the nuances of digital messaging, ensuring compliance, and maintaining the delicate balance between persuasive marketing and intrusive spam. Understanding Spam: What Makes Your Communication Unwanted? Spam is often perceived as unsolicited, irrelevant, or overly frequent communication that clutters inboxes and irritates recipients. It’s not just about the content but also about the context and consent. Recognizing these factors is the first step in ensuring your messages are welcomed rather than dismissed as spam. This part of the blog will delve into the characteristics of spam and how to differentiate your communications effectively. The...

You just lost $500. Not because your service wasn’t good enough. But because someone forgot about their appointment and didn’t show up. And here’s a fact: they probably would’ve shown up if they’d just gotten a simple text reminder. Missed appointments cost businesses billions annually. Late loan payments create cash flow nightmares for lenders. Guess what? Most of these no-shows and late payments are preventable. The solution isn’t hiring someone to manually call or text every client. The solution is automation. Specifically, automated SMS reminders using platforms like Easify. What Are Automated SMS Reminders? Think of automated SMS reminders as your digital assistant who never sleeps. Here’s how they work: You upload your contact list. Set up your trigger events: like “appointment booked” or “payment due in 3 days” and set up your message templates. When someone books an appointment or has a payment coming due, the automation fires off...

Getting a client to answer your call is harder than getting a text back from your ex. And honestly, your ex might still answer faster. At least they’ll hit you with the classic “new phone, who dis?” Your client, though? Straight to voicemail. But send a text, and suddenly they are replying. They reply while standing in line at Target, halfway through a TikTok scroll with latte in hand. That’s the reality. Calls are ignored, emails are chores, but texts are life. If you run a credit repair company, SMS is oxygen. Let’s dive into why SMS is becoming the secret weapon for credit repair companies and how you can use it to transform your business in 2026. The Evolving Landscape of Credit Repair in 2026 The credit repair industry has exploded in the past few years. Economic shifts, inflation, and financial uncertainty have left millions of Americans scrambling to...