SMS Templates for Insurance Policy Reminders and Updates

Insurance never makes it to the top of anyone’s to-do list. Some of your customers are racing between school drop-offs and late commutes. Others are running a business, answering client calls, or trying to...

Insurance never makes it to the top of anyone’s to-do list. Some of your customers are racing between school drop-offs and late commutes. Others are running a business, answering client calls, or trying to squeeze in a grocery run before dinner. The last thing they’re thinking about is policy paperwork.

So what happens? They forget. They delay. They push it off until it becomes a problem.

But here’s the good news: it doesn’t have to be this way. You could send a short, clear SMS:

This way, you’re making insurance simple again. No calls or inbox clutter. Just one tap is all that it takes.

That’s why SMS works for insurance: you stop chasing clients, and they stay covered without the hassle.

Why Use SMS for Insurance Reminders and Updates?

We’ve been over this a couple of times already: email open rates just won’t cut it for important updates. So, what communication channel can you rely on? The answer is always SMS. We’re talking 98% open rates within three minutes of delivery.

Think about it from your customer’s POV.

Lisa just bought her first home insurance policy. She’s already stressed about mortgage payments, moving boxes, and remembering to change her address everywhere. Now she has to track insurance deadlines too?

SMS makes her life easier instead of dumping more work on her plate.

The engagement difference is huge:

- Email: 20-25% open rates

- Phone calls: 30-40% answer rates

- SMS: 98% open rates, 90% read within 3 minutes

But engagement is just the beginning. SMS builds something even more valuable: trust.

When you send timely, helpful reminders, you’re not just collecting premiums. You’re showing customers you’ve got their back. That builds loyalty. Loyal customers renew policies, refer friends, and forgive the occasional hiccup.

The math works out beautifully too. A customer who misses a payment isn’t just late. They might lapse entirely. Acquiring a new customer costs 5-25 times more than retaining an existing one. A simple SMS reminder can save you thousands in acquisition costs.

Best Practices for Insurance SMS Communication

Great SMS communication isn’t about cramming everything into 160 characters. It’s about respecting your customer’s time and attention.

Keep it short and scannable. Your message should be digestible in a glance. If someone needs to re-read it twice to understand, you’ve lost them.

Bad: “This message is to inform you that your automobile insurance policy #AUT-2024-789456 is scheduled to expire on December 15th, 2024, and you should take immediate action to renew.”

Good: “Hi Mike! Your car insurance expires Dec 15. Renew now → link”

Personalization goes beyond “Hi {Name}.” Use details that matter to them. Policy type. Coverage amounts. Specific dates. When customers see information that’s clearly about their exact situation, they pay attention.

“Your home insurance ($300K coverage) renews Nov 20” hits different than “Your policy expires soon.”

Make your call-to-action crystal clear. Don’t make people guess what you want them to do. “Review,” “Renew,” “Pay Now,” “Call us” – one clear action per message.

Timing is everything. Send reminders when people can actually act on them. Not at 11 PM when they’re winding down. Not at 6 AM before coffee kicks in. Aim for business hours when they’re alert and able to handle admin tasks.

Easify’s smart scheduling and automation features let you set these optimal send times automatically, so your messages land when customers are most likely to engage.

SMS Templates for Insurance Policy Reminders & Updates

Ready-to-use templates save time and ensure consistency. Here are some ready-to-use templates we’ve curated for you. But remember – these are just starting points. Customize them for your brand voice and specific customer needs.

Premium Payment Reminders

Friendly reminder before due date:“Hi {Name}! Your Policy Type payment ($Amount) is due Date. Pay securely → Link. Questions? Reply HELP.”

Last call for overdue payments:“Important: Name, your Policy Type payment is X days overdue. Avoid coverage gaps → Pay now Link or call us at Phone.”

The key difference? The first message is helpful. The second creates appropriate urgency without being threatening. You’re protecting their interests, not hassling them.

Policy Renewal Notifications

Upcoming renewal alerts:“Good news, Name! We’re renewing your Policy Type for another year. New rate: $Amount. Questions about your coverage? Link”

Renewal confirmation message:“All set! Name, your Policy Type is renewed through Date. Your new policy documents are ready → Link”

Notice how the first message frames renewal as good news? That’s intentional. Renewals mean continued protection. Celebrate that.

Policy Updates & Changes

Coverage updates:“Update: Name, your Policy Type now includes New Coverage. No action needed. Details → Link”

Policy document availability:“Name, your updated policy documents are ready! Download securely → Link. Keep them handy for claims.”

Updates can make customers nervous. Lead with reassurance, then provide details.

Claim Updates

Claim received confirmation:“Claim received! Name, we’ve got your Claim Type claim (#Number). Next steps and timeline → Link”

Claim status updates:“Update on claim #Number: Status. Estimated completion: Date. Questions? Call Phone or visit Link.”

Claims are stressful. Your SMS should reduce anxiety, not add to it. Clear information and next steps are everything here.

General Customer Engagement

Festive greetings + insurance awareness:“Happy holidays, Name! Traveling? Your Policy Type travels with you. Safe travels → Link for coverage details.”

Cross-selling/up-selling policies:“Hi Name! With your new home, consider umbrella insurance for extra protection. Get a quote → Link”

Engagement messages should provide value, not just push sales. The holiday message reminds customers about existing benefits. The cross-sell message addresses a real need.

Tips for Maximizing SMS Effectiveness

- Timing matters more than you think. Send payment reminders 5-7 days before due dates. For renewals, start the conversation 30 days out.

- Follow-up reminders. Send another reminder 24-48 hours before the deadline. Some customers need that gentle nudge.

- Multi-channel support. SMS doesn’t replace email. It complements it. Use email for full documents, SMS for quick reminders.

- Automation at scale. Manual SMS works with 50 customers, but automation is essential at 500 or 5,000.

- Personalized automation. Use dynamic fields and triggers for names, policy details, and dates.

- Measure & improve. Track open rates, CTR, conversion rates. A/B test wording, timing, CTAs.

What works for auto insurance might not work for life insurance. What resonates with 25-year-olds might fall flat with 55-year-olds. Let the data guide your improvements.

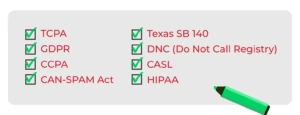

Compliance and Security Considerations

- Opt-in rules are non-negotiable. Customers must explicitly agree to receive SMS communications.

- Easy opt-out. Every message should include: “Reply STOP to unsubscribe.”

- Protect sensitive info. Never include full policy numbers, SSNs, or payment details in SMS. Use partial references.

- Stay compliant with regulations. Rules vary by state and insurance type. Always work with compliance teams.

Conclusion

SMS transforms insurance communication from a headache to a customer service superpower. Your customers are already checking their phones 96 times a day. Meet them where they are with messages that actually help instead of overwhelming them.

The benefits compound quickly:

- Better communication → fewer missed payments

- Fewer missed payments → lower lapse rates

- Lower lapse rates → higher customer lifetime value

- Higher LTV → a healthier business

But it starts with that first text message. The one that makes your customer’s life a little easier instead of a little harder.

Ready to send that text? Easify’s SMS automation platform makes it simple to send the right message at the right time to the right customer. Start your 7-day free trial today!

Navigating the Complex World of Digital Communication with Easify In the ever-evolving landscape of digital marketing, the thin line between effective communication and spam is crucial. Easify’s AI Compose tool emerges as a key player, ensuring that your SMS and email campaigns reach their intended audience without being flagged as spam. This tool stands out by understanding the nuances of digital messaging, ensuring compliance, and maintaining the delicate balance between persuasive marketing and intrusive spam. Understanding Spam: What Makes Your Communication Unwanted? Spam is often perceived as unsolicited, irrelevant, or overly frequent communication that clutters inboxes and irritates recipients. It’s not just about the content but also about the context and consent. Recognizing these factors is the first step in ensuring your messages are welcomed rather than dismissed as spam. This part of the blog will delve into the characteristics of spam and how to differentiate your communications effectively. The...

You just lost $500. Not because your service wasn’t good enough. But because someone forgot about their appointment and didn’t show up. And here’s a fact: they probably would’ve shown up if they’d just gotten a simple text reminder. Missed appointments cost businesses billions annually. Late loan payments create cash flow nightmares for lenders. Guess what? Most of these no-shows and late payments are preventable. The solution isn’t hiring someone to manually call or text every client. The solution is automation. Specifically, automated SMS reminders using platforms like Easify. What Are Automated SMS Reminders? Think of automated SMS reminders as your digital assistant who never sleeps. Here’s how they work: You upload your contact list. Set up your trigger events: like “appointment booked” or “payment due in 3 days” and set up your message templates. When someone books an appointment or has a payment coming due, the automation fires off...

Getting a client to answer your call is harder than getting a text back from your ex. And honestly, your ex might still answer faster. At least they’ll hit you with the classic “new phone, who dis?” Your client, though? Straight to voicemail. But send a text, and suddenly they are replying. They reply while standing in line at Target, halfway through a TikTok scroll with latte in hand. That’s the reality. Calls are ignored, emails are chores, but texts are life. If you run a credit repair company, SMS is oxygen. Let’s dive into why SMS is becoming the secret weapon for credit repair companies and how you can use it to transform your business in 2026. The Evolving Landscape of Credit Repair in 2026 The credit repair industry has exploded in the past few years. Economic shifts, inflation, and financial uncertainty have left millions of Americans scrambling to...