The Role of SMS in Digital Transformation of Finance Companies

Dear finance pros, Your customers are buried in emails, overwhelmed by ads, and ignoring endless robocalls. If you want their attention, meet them where they actually respond: through text. Financial services are rapidly digitizing...

Dear finance pros,

Your customers are buried in emails, overwhelmed by ads, and ignoring endless robocalls.

If you want their attention, meet them where they actually respond: through text.

Financial services are rapidly digitizing — from mobile banking to AI-driven credit scoring.

Yet, digital transformation isn’t just about apps and portals.

It’s about how companies communicate with customers.

While your competitors are fighting for scraps of attention in crowded inboxes, SMS delivers your message straight to your customer’s hand.

No spam folders or algorithm gatekeepers. Just you, your offer, and a 98% open rate that makes email marketers weep with envy.

For finance companies, this isn’t just about marketing. It’s about survival.

When a customer needs a loan approval update or payment reminder, they don’t want to dig through promotional emails.

They want instant communication that helps them move forward.

That’s exactly what SMS delivers.

And in 2025, it’s becoming the secret weapon that separates thriving finance brands from those still playing catch-up.

👉 Launch your first SMS campaign with Easify – Try Easify free for 7 days!

Why SMS Marketing Works So Well for Finance

Your customers live on their phones. That is pretty much the only reason you need to switch to SMS marketing.

If you’re still not convinced, here’s more:

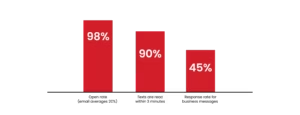

SMS has engagement rates that make other channels look amateur:

- 98% open rate (email averages 20%)

- 90% texts are read within 3 minutes

- 45% response rate for business messages

Digital Transformation in Finance: Where Does SMS Fit In?

Customer expectations have evolved — 24/7 access, instant support, mobile-first communication.

Your loan applicants aren’t sitting at desks waiting for your emails.

They’re checking their phones between meetings, during commutes, or while grabbing coffee.

And SMS is convenient.

SMS bridges the gap between legacy systems and modern digital experiences.

It brings together trust, speed, and personalization.

Finance moves fast. Loan approvals expire. Interest rates change. Payment deadlines approach.

SMS lets you communicate urgently — without interrupting or seeming desperate.

When you send a pre-approved loan offer via SMS, you’re doing them a favor.

Instead of waiting for them to open an email hours later, you’re giving them the simplest way to respond right away.

Key Roles of SMS in Financial Services’ Digital Journey

Here’s how finance companies are actually using SMS to drive results:

Customer Acquisition & Lead Nurturing

Sending pre-approved loan offers instead of generic “Apply Now” emails.

Example:

Direct. Personal. Urgent without being pushy. SMS serves as a bridge between ad clicks and conversions.

Lead capture follow-ups:

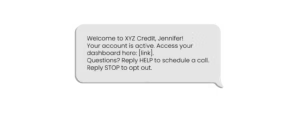

Customer Onboarding & KYC

OTPs and verification codes: This is where security meets convenience.

Customers expect SMS verification. It’s faster and more trusted than email codes that might hit spam folders.

Welcome messages and document submission reminders:

Keep it brief, actionable, and welcoming.

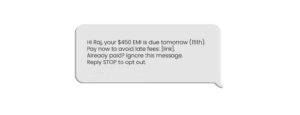

Payments & Collections

EMI reminders and payment confirmations:

EMI reminders are time-sensitive — so what is the best way to send them? Via texts.

This beats robocalls every time — clear, non-confrontational, and includes an easy action step.

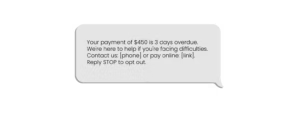

Friendly overdue alerts:

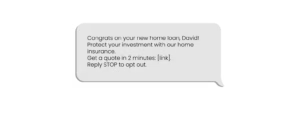

Customer Engagement & Retention

Credit limit increase alerts:

This feels like a reward, not a sales pitch.

Investment or insurance add-ons:

Feedback surveys:

“Hi Maria, how was your recent loan experience? Rate us 1-5 by replying to this message. Takes 5 seconds! Reply STOP to opt out.”

Short surveys get higher response rates than lengthy email forms.

Risk & Compliance Support

Fraud alerts, account activity notifications, consent confirmations — all help maintain transparency and regulatory compliance while keeping customers informed and in control.

Support ticket updates:

“Your inquiry #12345 has been resolved. Check your email for details or reply HERE for more help. Reply STOP to opt out.”

Compliance and Security: Building Trust with SMS

SMS in finance isn’t the wild west. You need to play by the rules.

But they’re not as complicated as you think.

And guess what? Easify makes them easy!

Key Regulations Across Markets:

- TRAI (India): Explicit consent, DLT registration, and time restrictions

- TCPA (US): Get explicit consent, honor opt-outs, don’t message before 8 AM or after 9 PM

- GDPR (EU): Data protection, consent management, and customer rights

The importance of consent-driven communication cannot be overstated.

Never buy SMS lists. Ever. Build your own through legitimate channels:

- Website opt-ins during loan applications

- Checkbox consent during account opening

- QR codes on marketing materials

- Social media lead magnets

Make the value clear: “Get loan updates and exclusive offers via SMS.”

SMS Security for Finance

Use platforms with encryption (in transit and at rest).

Never send full account numbers or sensitive data in SMS.

Share only partial info and guide customers to secure portals for details.

Opt-Out Compliance

Always include clear opt-out instructions like “Reply STOP to unsubscribe” and act on them right away.

Ignoring opt-outs risks heavy fines and damages trust.

SMS: Driving Efficiency & ROI in Finance

Real-Time Updates to Reduce Defaults & Churn

Proactive SMS keeps customers on track with payments and commitments.

Timely reminders with clear steps help prevent missed obligations, protecting both revenue and relationships.

Cost-Effective vs. Traditional Media

Finance keywords on Google Ads can cost $50+ per click.

SMS costs just pennies per message — reaching qualified leads directly instead of casting broad, expensive nets.

Scalable for Any Institution

Whether you’re a startup, NBFC, or large financial institution, SMS strategies scale with your needs — while maintaining the personal touch that drives results.

How Easify Powers Finance SMS

- Pre-Built Automation Workflows: Ready-to-use EMI reminders, KYC follow-ups, loan approvals, and more

- CRM + SMS Integration: Syncs with your customer data to deliver timely, personalized messages

- Real-Time Analytics: Track delivery, clicks, and conversions — know what works, optimize what doesn’t

- Compliance-Ready Opt-In Management: Built-in consent tracking for TCPA, GDPR, and more

- Finance-Tailored Templates: Customizable reminders, approvals, and collection messages

👉 Try Easify free – empower your finance business with an AI-powered SMS platform.

Real-World Results

30% Higher EMI Collections

A lending company replaced robocalls with SMS reminders.

Customers responded faster to polite texts with payment links — boosting collections and reducing complaints.

40% Faster Onboarding

A mortgage broker cut document delays by 40% with SMS reminders.

Timely texts with clear steps eliminated back-and-forth emails, speeding up approvals.

These aren’t exceptions — they’re consistent results finance companies achieve with SMS.

Pitfalls to Avoid

Now that we’ve talked about the best practices for SMS marketing, here are some things to avoid:

- Treating SMS like spam instead of trusted communication

- Overloading customers with irrelevant or excessive messages

- Ignoring compliance rules and opt-in processes

- Skipping analytics and flying blind

Conclusion

SMS is a strategic enabler for finance.

With 98% open rates, 90% of texts read in 3 minutes, and up to 45% response rates, SMS offers direct, personal engagement at scale.

Finance companies using SMS today are:

- ✅ Building trust

- ✅ Reducing churn

- ✅ Driving measurable growth

With Easify, compliance and scalability are handled for you.

Start your digital transformation with Easify. Get started today!

A text message sender gives your outreach the visibility most channels fail to deliver. Your customers often engage with text messages. On the other hand, emails and outbound calls are usually ignored. If your outreach depends on the latter-mentioned channels, you are operating with lower visibility than necessary. Whether you are running a dental practice, a retail store, a real estate or insurance agency, or a five-person marketing team, the way you communicate with customers matters. Text messaging is not just faster. It gets results. Let’s break down everything you need to know. What is a Text Message Sender? A text message sender is software that lets businesses send SMS to their customers at scale. With this software, you manage contacts, send texts, and track results from one centralized platform. Here is how it works: you upload a list of contacts (or build one through opt-ins), write your message, personalize it with the customer’s name or other details, and then either send it immediately or schedule it for later. The platform...

You’re here because you need to text your customers, but you’re not sure which option to pick. SMS vs MMS isn’t just tech jargon. It’s a real decision that affects your budget, engagement rates, and whether people actually read what you send. As a business owner trying to reach customers, you’re probably wondering: should I send a text message or one with a picture? And does it actually matter? Well, yes. It does. SMS and MMS aren’t the same thing. They cost different amounts. They work differently. And if you pick the wrong one for the wrong situation, you’re either wasting money or missing out on engagement. Let’s fix that with this guide. Key Takeaways (TL;DR) Here’s what you need to know right now: SMS is plain text. Fast, cheap, works everywhere. Perfect for reminders, alerts, and quick updates. MMS includes images, videos, and other media. Costs more but gets way more engagement. Great for promotions and anything visual. When to use SMS: Appointment confirmations, delivery updates, verification codes, time-sensitive alerts. When to use MMS: Product launches Event...

Navigating the Complex World of Digital Communication with Easify In the ever-evolving landscape of digital marketing, the thin line between effective communication and spam is crucial. Easify’s AI Compose tool emerges as a key player, ensuring that your SMS and email campaigns reach their intended audience without being flagged as spam. This tool stands out by understanding the nuances of digital messaging, ensuring compliance, and maintaining the delicate balance between persuasive marketing and intrusive spam. Understanding Spam: What Makes Your Communication Unwanted? Spam is often perceived as unsolicited, irrelevant, or overly frequent communication that clutters inboxes and irritates recipients. It’s not just about the content but also about the context and consent. Recognizing these factors is the first step in ensuring your messages are welcomed rather than dismissed as spam. This part of the blog will delve into the characteristics of spam and how to differentiate your communications effectively. The...